From 01.07.2020 to 31.12.2020, the German government will temporarily reduce the standard tax rate from 19% to 16% and the reduced tax rate from 7% to 5%. This is part of the economic stimulus package that was passed due to the Corona pandemic.

In order to prepare SAP® Business ByDesign® for this tax reduction (and the subsequent tax increase), appropriate configurations are necessary in the system. These steps are described in the following article.

-

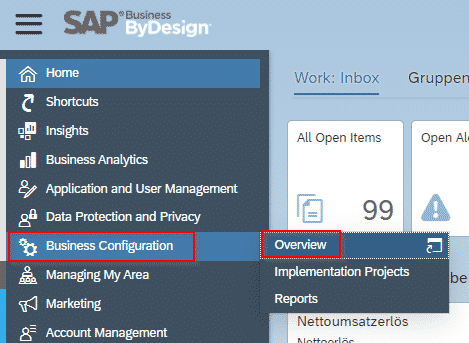

- Open the Workcenter: “Business Configuration” – and the View: “Overview”:

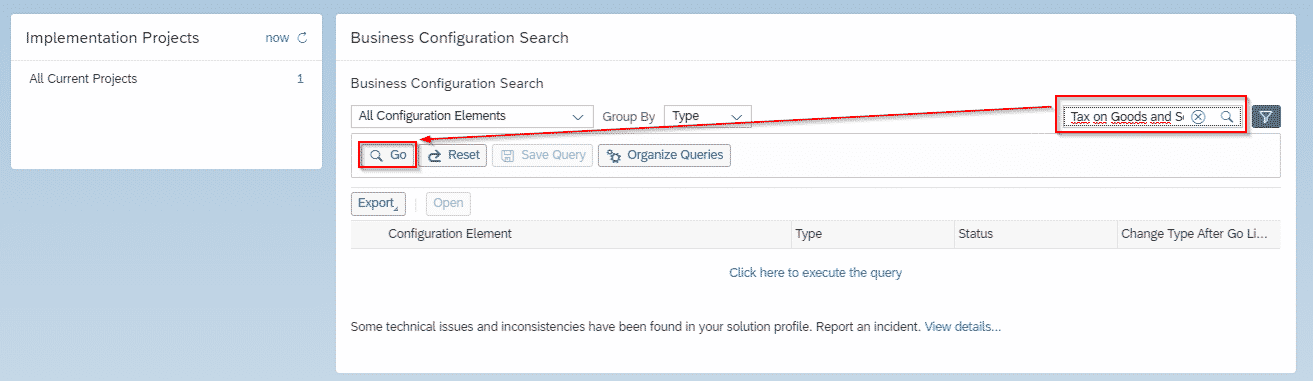

- Search for the task “Tax on Goods and Services”:

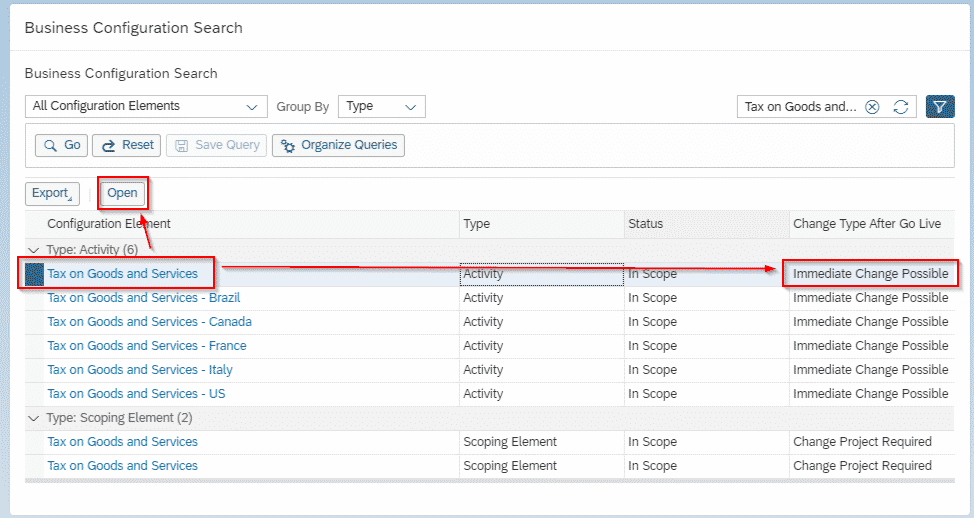

- Select the task “Tax on Goods and Services” with the Change-Type “Immediate Change Possible” and click on “Open“:

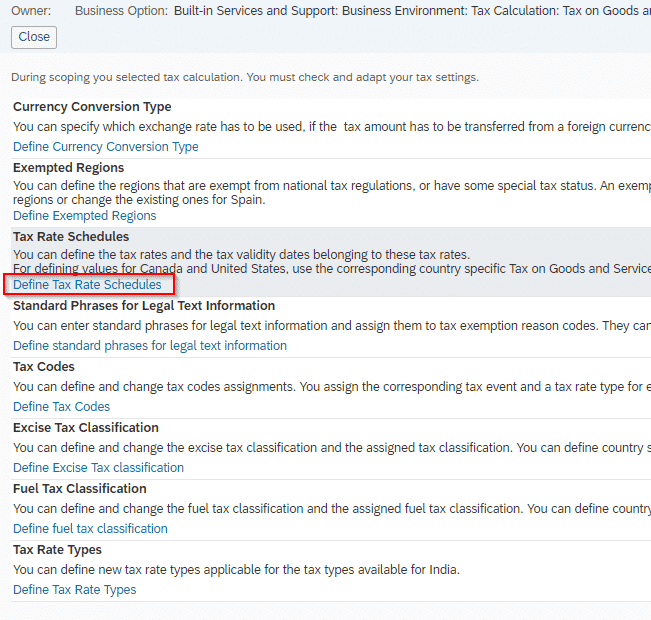

- Open the task “Define Tax Rate Schedules“:

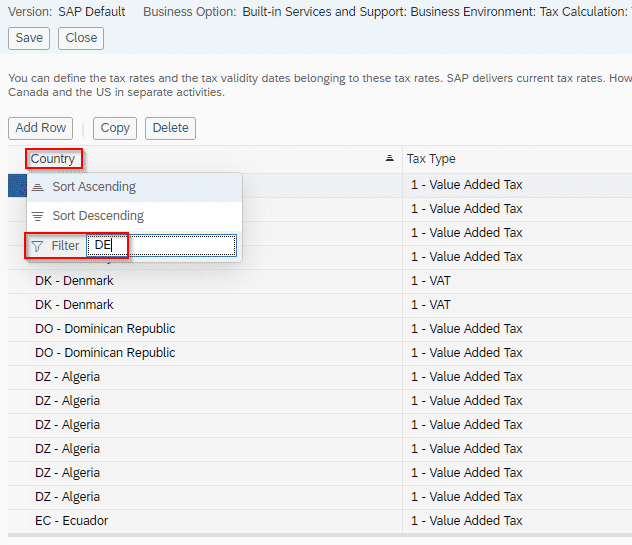

- As the tax reduction only affects Germany and no other country, select the column “Country” and search for the code “DE“:

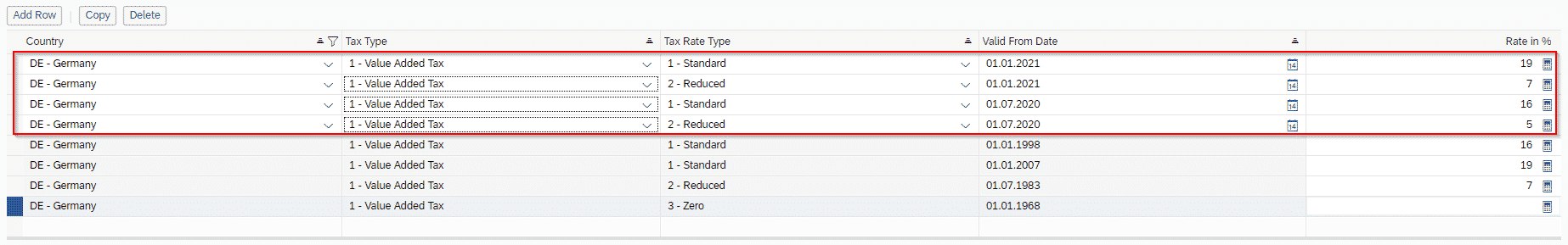

- Now add the following tax rates to the table:

- 19% sales tax as of 01.01.2021 (provision of the sales tax at the end of the temporary tax reduction)

- 7% reduced sales tax as of 01.01.2021 (provision of the reduced sales tax at the end of the temporary tax reduction)

- 16% sales tax as of 01.07.2020 (discontinuation of the temporarily reduced sales tax as of the specified validity)

- 5% reduced sales tax from 01.07.2020 (discontinuation of the temporarily reduced sales tax from the specified validity)

- Trouble-Shooting: Is the task read-only? Then the following workaround helps:

- In the “Business Configuration” work center, switch to the “Implementation Projects” view

- Select the current open implementation project and click on “Open task list“

- Within all tasks, look for the task “Tax on Goods and Services” and continue from point 4.

- Which of the available tax rates is used in the SAP document depends on whether the business document is subject to standard tax on sales/purchases or reduced tax on sales/purchases and the validity period of the document date.

- Open the Workcenter: “Business Configuration” – and the View: “Overview”:

Statements on projects, customer contracts or other SAP documents, for which invoices extend over several validity periods of the tax rate table within the scope of the performance period, may have to be checked individually.